Money isn’t just about how much you earn. It’s really about how you manage it. You can earn a large amount of salary and still feel broke at the end of the month if you don’t plan. On the other hand, even a modest income can take you places if you save and invest wisely.

That’s where savings plan come in. A good plan doesn’t just save your money — it helps it grow in a way that matches your life goals. And those goals can be very different for everyone. For you, it might be buying your first car. For someone else, it might be a wedding, or setting up a retirement fund.

The point is: your goals decide your strategy. Let’s break it down simply into short-term, medium-term and long-term goals.

Short-Term Goals: The Quick Essentials

Short-term usually means 1 to 3 years. Think, a vacation, upgrading your phone, or keeping an emergency fund.

For these, safety comes first. You don’t want to take risks here. You just want your money accessible when you need it.

Good options are:

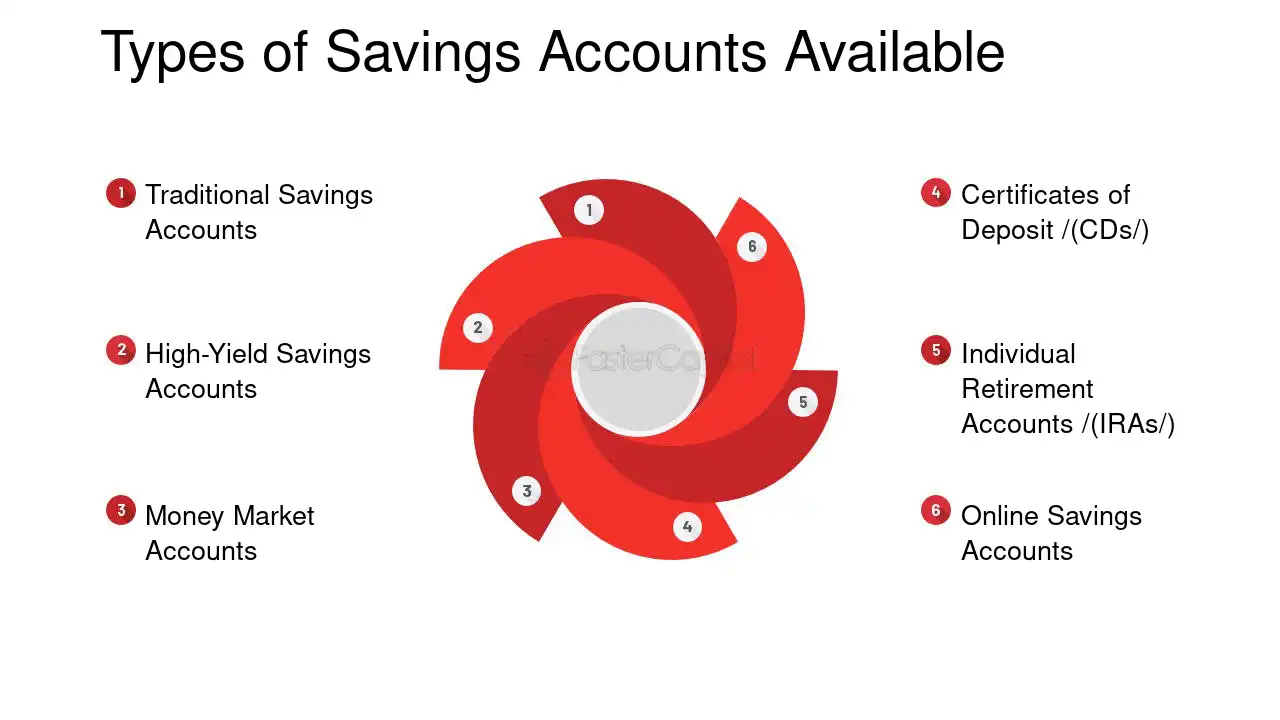

- High-yield savings accounts (better interest than regular ones).

- Short-term fixed deposits.

- Recurring deposits if you like saving a set amount every month.

Small hack: put a tiny portion in liquid funds. It helps your money keep pace with inflation without locking it away.

Medium-Term Goals: The Balance Game

Now we’re talking 3–7 years. This is where you may be saving for a wedding, your kid’s school fees, or that first home down payment.

Here, you can afford to take some risk, but not too much. You want growth, but you also want peace of mind.

Solid options include:

- Endowment policies (insurance + savings in one).

- Debt mutual funds (better than FDs, moderate risk).

- ULIPs (insurance + flexible investment).

- Gold or sovereign bonds (steady and reliable).

The key here is balance. Keep a chunk in safe savings products, and let the rest grow with investments.

Long-Term Goals: Big Dreams, Big Growth

These are 7 years or more. Retirement. Buying property. Or maybe just building wealth for the next generation.

This is where compounding becomes your best friend. The longer your money sits and grows, the more powerful it gets.

Your go-to options:

- Public Provident Fund (PPF) — safe and tax-efficient.

- Equity mutual funds — higher risk, but brilliant over time.

- NPS — tailor-made for retirement, with equity + debt mix.

- Life insurance-based savings plans — guaranteed benefits plus protection.

Here, your savings plan is the safety net. But the investment plan? That’s the engine that drives your future wealth.

Align Savings with Goals

There’s no “best” savings plan in general. The best one is the one that matches your timeline.

- Short-term = safety and quick access.

- Medium-term = balance risk and returns.

- Long-term = let compounding do the magic.

At the end of the day, saving and investing isn’t about copying what everyone else is doing. It’s about making sure your money supports the life you actually want.

Once you start aligning your savings plan with your goals, money stops being stressful — and starts becoming a source of peace.